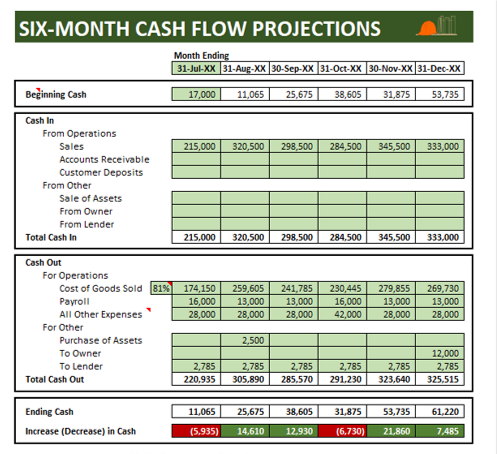

Forecasting Cash Flow

Forecasting Your Six-Month Cash Flow

|

Use this Cash Flow forecasting template to check your future financial health. |

|

To forecast your revenues

Where does money come from in your business? The first place to look is your Accounts Receivable, which is money owed to you for work you have already done. Then take a look at your current projects and anticipate when you will be receiving payment for work you do in the future. Enter those numbers in the Sales by month.

To forecast your other inflows

You may make the decision to sell assets, add more capital to your business, or borrow money via a loan or credit line. If so, enter those amounts in the month when you expect to receive the funds.

To forecast your Cost of Goods Sold (COGS)

The template asks for the amount of Accounts Payable, the percentage Cost of Goods Sold (defaulted at 78%) and the percentage of COGS that will be paid in the current month (defaulted at 50%). With these numbers, the monthly cash flow for Cost of Goods Sold can be calculated.

To forecast your Payroll

Enter the monthly Payroll amount.

Payroll expenses tend to be about the same month by month. Just look at your previous 4 months, and enter those amounts. If you are anticipating hiring more help three or four months in the future, make that adjustment.

To forecast your General and Administrative (G&A) expenses

Enter the other General and Administrative (G&A) expenses.

G&A expenses tend to be about the same month by month. Just look at your previous 4 months cash requirement to keep the business running, and enter those amounts.

To forecast your other outflows

You may decide to purchase an asset in the next six months. Enter the amount of cash that will be involved in the purchase. If you pay cash for the entire purchase price of the asset (think computer), enter that number. If you finance the purchase (think new truck), enter the amount of the down payment, and then add the monthly payment to the Lender category.

If the Owner will be taking cash out of the business other than through Payroll, enter those amounts in the "To Owner" line.

Add up all payments to Lenders, and enter in the "To Lender" line. If loan payments have been included in the "All Other Expenses", do not duplicate the expenses. I would deduct the Lender Payments from All Other Expenses, and enter at this line. Don't worry about breaking the interest and principal out, we are concerned with the total Cash Flow effect, not the expense allocations.

How to use the Cash Flow Forecaster

Once you have entered as much information as is required, you will be able to track your expected cash flow for your company. You will see if you should be concerned about a shortfall in cash or if you can rest easy.

If it looks like you are going to experience a problem in three months, you can make the decision to open a line of credit or find the cash to put into the company, or turn up the marketing.

This template provides a great opportunity to play "what-if" with your company finances.

Yes, you need to do this exercise every month!!!

Especially with respect to Revenue flow, you are going to be more confident about next month's numbers than about numbers five or six months out. Jobs you were counting on don't materialize, a job gets delayed in permitting, a job gets funded this month instead of two months from now. Financial circumstances change.

So you need to update this form as part of your financial review every month. Not only will the refreshed numbers provide extra confidence that you are on top of your cash situation, but you will get better at the forecasting process as well.